(2000) and we assume that book equity data are publically available five months after the fiscal year end date 2. The construction of B/M follows Davis et al. Daily trading volume and number of shares outstanding, monthly return and market value (MV) 1, and annual accounting data for calculating the book-to-market (B/M) come from the CRSP/ COMPUSTAT merged (CCM) database.

To check the robustness, we also test them using NYSE/Amex/Arca/Nasdaq stocks.

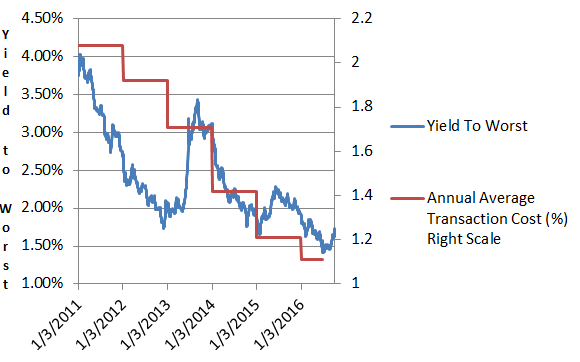

Because trading volumes for Nasdaq stocks are inflated relative to NYSE/Amex/Arca stocks due to interdealer trades, our main tests are based on NYSE/Amex/Arca stocks. Our sample includes all NYSE/Amex/Arca/Nasdaq ordinary common stocks over January 1926 to December 2011. Section 5, the portfolio performance test adjusted by liquidity risk. Section 4 is the cross-sectional regression analysis at the stock level. Section 3, the liquidity premium test based on Fama-French asset pricing model. Section 2, the measurement of transaction cost index and its correlation analysis. The rest of this paper is organized as follows. This paper takes the common stock of American stock market from June 1927 to December 2011 as the research sample to comprehensively explore the ability of transaction cost to predict stock returns. Due to the diversity and difference of transaction cost indicators, this paper selects four classic transaction cost estimates: Amihud & Mendelson (1986), Lesmond et al. Is transaction cost the determinant of asset return and can it be ignored in asset pricing? Does transaction cost directly or indirectly affect stock expected return? This paper attempts to find the answer from the comprehensive empirical research and fill in the empirical evidence of this problem. It can be seen that theoretically, whether the asset pricing power of transaction cost is first-order or second-order is still in dispute. But it’s worth noting that the large magnitude of portfolio return difference in the United States, Anthony and Tan (2011) found that the magnitude of liquidity premium and transaction cost spread is the first order, and transaction cost has asset pricing power. Then, Vayanos (1998, 1999) thinks that the transaction cost mainly affects the holding period and trading volume, and the impact on the expected return is the second order. On the meaning of asset pricing of transaction cost, Constantinides (1986) found that although transaction cost affects asset demand, the impact on asset return is the second order, that is, when investors face large transaction cost, they can adjust it by reducing transaction frequency and volume. It’s not surprising that portfolio return difference exists.

A lot of literatures have found that there is a high-low portfolio return gap formed by some liquidity indicators. Stocks with lower liquidity will have higher expected return, which marks the establishment of liquidity premium theory. The research of liquidity starts from bid ask spread (Amihud and Mendelson, 1986). Transaction cost measures the width of liquidity. Therefore, transaction cost analysis, transaction cost asset pricing power research is very important. With the improvement of corporate governance, market transparency and pricing efficiency, there is less and less room to earn excess profits. Since then, the securities market has begun to pay attention to transaction cost. In 1986, the Department of labor of the United States issued guideline 86-1, which requires the financial market to focus on transaction cost.

The lower transaction cost enables investors to quickly change their investment portfolio according to market information, accelerate the reaction of stock price to innovation of information, and make the market more efficient and transparent. Lower transaction cost means that the stock price will not be greatly distorted due to incomplete information and sudden changes in supply and demand, which makes the market more stable. Lower transaction cost means higher liquidity. Liquidity and transaction cost are actually “the positive and negative sides of the coin”. Transaction cost is composed of direct transaction cost and implicit transaction cost (Demsetz, 1968), which is the comprehensive embodiment of market quality and an important factor of the core competitiveness of stock exchange.

0 kommentar(er)

0 kommentar(er)